Boot Barn Holdings Inc (BOOT)

TLDR: HOLD

Macro ◇ Management ◇ Risks ◇ Fundamentals

◇ Valuation ◇ Investors

Boot

Barn (BOOT) is a US retail chain that sells western and work-related footwear,

apparel, and accessories to a diverse customer base, including enthusiasts and

blue-collar workers. Even with current negative macroeconomic factors,

including short-term demand destruction for consumer cyclical, revenue growth supports

that the business's profits will continue to rise, making it an investment

opportunity available at a staggering discount for investors with a medium to

long-term time horizon.

- Sustainable competitive advantage while trading at attractive valuations, with potential future valuations becoming more favorable.

- Impressive business growth, solidifying itself as the industry leader in a niche market.

- Macroeconomic factors will allow the investor to get in at the trough of the consumer cyclical.

Business Model

Boot Barn is a US-based retail chain that specializes in western and work-related footwear, apparel, and accessories. As anticipated for March 2023, the company will have 346 store locations across 38 states. The company plans to expand its store base to around 900 locations, with an average net cash investment of $1.2 million per location and aims for a payback period of three years. The company has invested in resources and infrastructure to support this expansion and is shooting for a store base growth of 10% annually, at a rate of 11 stores per quarter. Boot Barn targets a diverse customer base, including western and country enthusiasts and people looking for durable workwear. The company's product range includes a wide selection of western and work boots, coordinating apparel and accessories, and features popular brands such as Ariat, Carhartt, and Wrangler. The company has a solid financial performance and is expanding its national presence through organic growth and strategic acquisitions of competing chains.

Their competitive advantage comes from strong brand recognition, an e-commerce presence, and a differentiated shopping experience. The company has a portfolio of exclusive brands, a versatile store model, and a highly experienced management team. It is investing in both online and in-store advertising to improve its overall customer experience, has a strong e-commerce presence through its websites, and is implementing various omnichannel initiatives to offer customers a seamless shopping experience. Boot Barn has a significant advantage over other brands: they have 3x more stores than their nearest direct competitor, a recognizable brand, ample inventory, exclusive product offerings, and strong supplier partnerships.

The above information was gathered from Boot Barn's annual filing.

Macro Environment

The consumer discretionary sector had a difficult year in 2022 due to the impact of inflation and recession fears on consumer spending. Inflation led to higher costs for this sector in production, transportation, and sales of their goods, while consumers reduced their discretionary spending, leading to an overall decline in demand. For 2023, the performance of the sector will likely depend on the outcome of macroeconomic concerns, such as the end of the Fed's rate hike cycle and inflation. Stock valuations within the sector are attractive as a whole, so picking up undervalued companies with a strong business model and growth prospects would offer a good combination of low valuations and good long-term drivers to invest in during the later stock market trough.

Fundamental Analysis

Weaknesses

Profit Margin: Currently the Gross Margin is 37% and has been steadily growing throughout the last 6 years on a quarterly basis of 1.63% from the gross margin lows of 28%. The ratio currently indicates that margins are being eroded by competition, however, the growth has been steadily increasing to some of the best gross margins in BOOT’s history. This company is still in the average industry range for this metric, but to truly show it is a leading business with pricing power, we must continue to watch this metric to ensure it continually improves.

Cash Reserves: Boot Barn's cash reserves are indicated by its Quick Ratio, which is currently at an extremely low .26. This suggests that the company may be over-leveraged and could have trouble paying off its short-term obligations in the event of a market downturn. It’s worth noting that the company's cash flow has been inconsistent, with large swings and negative cash flow in recent times, which indicates the company is putting most of its cash into reinvesting in future growth. The company's debt ratios are well-managed, but overspending on capital expenditures may hurt the business in the short term if there is demand destruction from macroeconomic factors. The company's Quick Ratio, which measures its ability to pay off short-term obligations with its current most liquid assets, is in the 88th percentile for the industry, showing further evidence that cash is not being held for any other expenses besides capital expenditures. On the bright side, the Cash Ratio is improving by 25% on a quarterly basis, indicating that the company is addressing this weakness and the company's Quick Ratio is growing more efficiently over time.

Receivables: Boot Barn collects its receivables remarkably well compared to its peers, but as indicated by its Receivables Turnover, the metric has been slowly getting worse and is worth keeping an eye on especially as the economy slows down and there is less consumer demand.

Inventory Management: The Inventory Management aspect of Boot Barn's business appears to have become increasingly problematic since 2020. The company has been taking longer to generate cash from its inventory, which is indicated by the worsening CCC and Inventory Turnover. CCC has been around 96 in recent years, which is considered high compared to its peers, but still acceptable with room for improvement. Currently, the CCC is at 122, indicating a lack of efficiency in management and a slow process of generating cash from inventory. This may be a result of poor sales strategy or ineffective inventory management, which can result in high storage costs and unsold goods with no return. Additionally, the company is collecting payments from its customers more slowly than its peers, as indicated by the Receivables Turnover, which may further impact its financial performance.

Strengths

Boot Barn is a strong competitor in the retail industry, with several advantages over its peers. These advantages are highlighted by the company's financial metrics:

Net Profit Margin: This is a crucial indicator of a company's overall health and competitiveness. This higher-than-average ratio indicates that the company is more efficient in generating profits and has better control over its costs. A higher Net Profit Margin means that Boot Barn can invest more in its business, leading to growth and further advantages in the future, and provides financial stability for the company during economic downturns.

Operating Margin: This shows the efficiency and profitability of the company's operations over its competitors. A higher operating margin means the company is more resilient during economic slowdowns and has strong management and effective cost control. This gives Boot Barn a competitive edge in the retail industry, where margins can be thin and competition is intense.

ROIC: A higher ROIC is an important note because it highlights the relationship between the cost of raising capital and the returns generated from their investments. A higher ROIC indicates that the company is making more money from its investments compared to its peers and is using its capital efficiently and effectively. This makes the company more competitive, financially flexible, and attractive to investors.

ROE: This metric indicates that the company is using its shareholder equity more effectively to generate profits. A higher ROE shows that the company is well-managed, financially successful, and able to create value for its shareholders. This makes Boot Barn more attractive to investors and lenders and can increase investor confidence in the company.

ICR: Boot Barn has a higher ICR than its peers in the industry, which demonstrates the company's ability to effectively manage its financial obligations and maintain profitability. A high ICR indicates that the company is generating enough revenue to cover its interest expenses and is in a strong financial position with a lower risk of defaulting on debt obligations. This makes Boot Barn more creditworthy and attractive to investors and provides the company with financial stability and the ability to pay dividends.

Boot Barn's higher-than-average financial metrics in several key areas show that the company is efficient, profitable, and well-managed. These advantages provide financial stability and make Boot Barn more competitive, attractive to investors, and well-positioned for future growth. This means if they choose, they could reduce their capital expenditures to whether the demand destruction probably coming in the current economic downturn.

Latest Earnings Call Transcript (Q3 ‘23)

Boot Barn reported strong results for the third quarter of the fiscal year. Total sales grew 5.9% driven by strong sales from new stores opened over the past 12 months, and on a three-year basis, total sales have grown significantly compared to the third quarter of fiscal 2020. The merchandise margin rate declined by 190 basis points due to higher freight expense, but the company maintained its full-price selling posture and was able to achieve a merchandise margin rate close to last year's performance after normalizing for the freight headwinds. The company plans to open 43 new stores this fiscal year, which is more than 14% growth, and their new store model is now $3.5 million, generating nearly 100% cash-on-cash returns. The success of their new stores in new and existing markets gives the company confidence in their ability to expand to more than 900 stores in the country. Same-store sales performance in the third quarter was down 3.6% with consolidated same-store sales while cycling 54.2% of same-store sales growth in the prior year period. The team is expanding customer reach by modernizing the brand and tailoring communication to each customer segment. The company is focusing on strengthening its omnichannel leadership by integrating its stores and digital channels, with approximately 60% of online orders involving a store associate. The company added in-store fulfillment to its omnichannel offering, which has resulted in shorter delivery times and exclusive brand sales online. The CEO stated how he is very pleased with their third quarter business and believes their runway for future growth is extremely promising. Boot Barn has nearly doubled the size of the business in just three years and achieved store productivity levels that far exceed pre-pandemic levels. As they head into fiscal '24, they have multiple levers of earnings growth from same-store sales and new-store openings to margin accretion from exclusive brands and lower freight charges.

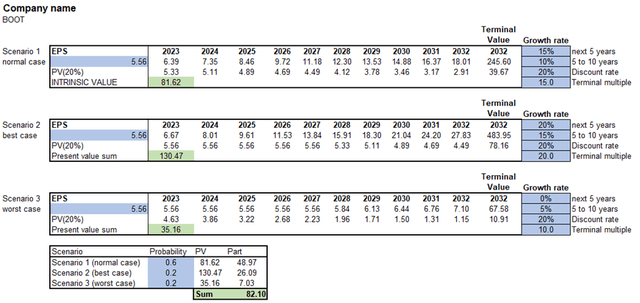

Valuation

Taking into account the fundamental strengths, weaknesses, and the most recent earnings report, Boot Barn is poised for significant growth. The late-2023 to early-2024 stock market decline and multiples compression should enable value buyers to pick up this stock significantly discounted. While the downturn will only be a temporary reflection of consumer demand and earnings destruction due to macroeconomic factors, the future growth, and reputation have been consistent over the last 5 years with no signs of slowing down. Boot Barn would be in a great position for those that enjoy a buy-and-hold strategy while also grabbing a stock with a considerable margin of safety.

Referencing the chart above, scenario 1 highlights the normal projected case, with the growth rate of 15% being selected due to Boot Barn’s 10y annual revenue growth averaging about this rate. When looking at the Owner's Earnings for the company, things can get a little confusing. Due to the capital expenditures and change in working capital since 2020, it looks like the company has had negative earnings. This couldn't be more misleading, as the company has grown dramatically over the last 3 years: March 2019 ((TTM)) had 1.29 Owner Earnings per Share, March 2021 ((TTM)) had 2.84, and then March 2022 had a theoretical 6.6 if you utilize the normal change in working capital of -10M vs the more recent -186M that was reported. For this reason, even listing a 20% growth rate over the next 5 years seems conservative for scenario 2. The terminal multiple increased to 20 for this scenario as well since that seems to be easily within reach for this company, through analysis of historical their PE and the overall industry PE for retail apparel chains. For scenario 3, the DCF highlights if the company did not grow at all for the next 5 years, then grew only at a 5% rate from years 5 to 10 with a severe reduction in the terminal multiple, all of which are highly unlikely.

Overall, I believe purchasing the stock under $82.10 would yield the investor a minimum of 20% annual return over the next 10 years. If market cycle timing is preferable, the investor could get a higher margin of safety if they wait over the next year or so for macroeconomic factors to take effect on the retail industry, likely reducing share prices in many companies no matter their prospects.

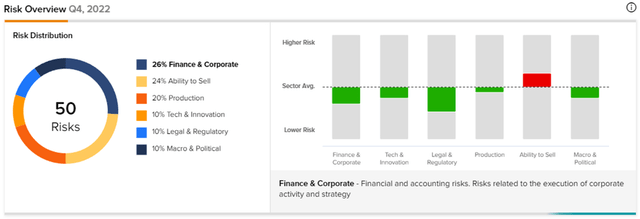

Risks

Boot Barn is exposed to several investment risks including dependence on maintaining a strong brand image, dependence on foreign countries to produce its merchandise, and the challenges of opening new stores and integrating acquired stores. The company is also susceptible to international trade risks and conditions, such as the impacts of COVID-19 or geopolitical conditions.

It is worth noting that Boot Barn does not own any real estate and has significant lease payments for its retail stores, Store Support Center, and distribution centers which may strain its overall cash flow. The company also has a significant amount of outstanding debt which may limit its flexibility to respond to changing business and economic conditions, and if interest rates increase, its debt service obligations could increase negatively impacting its net income. This would also hurt its short-term pricing, allowing again for investors an entrance into the stock with attractive discounted pricing.

Conclusion

Overall, considering the macroeconomic factors, I give the stock a hold rating. I believe Boot Barn has an amazing future ahead of it, especially with investors that can wait 5 - 10 years to realize their profits, however, demand destruction will take a toll on all businesses in this sector. Investors that can tolerate high volatility should begin dollar cost averaging later this year to lock in a favorable entry price on this high-growth company. Boot Barn has a very attractive future, and despite its short-term pain, should yield a fantastic return with a substantial margin of safety.

◇ ◇ ◇

My personal entrance will likely be sub-$60 for BOOT, however, I currently have no position in this company. Looking at extreme optimism, a sub-$30 entrance may be possible with an economic downturn.

Since the original report is 40 pages long with 9,200 words, it has been broken into a more summarized 1,900-word article.

If you would like the comprehensive BOOT report with access to future reports on other companies, consider subscribing to my Patreon.

Supporting Articles & Videos

Free Articles:

- Boot Barn Holdings Inc 10K, 2022

- Boot Barn Holdings Inc 10K, 2021

- Boot Barn Holdings Inc 10K, 2020

- Boot Barn Holdings Inc 10K, 2019

- Jim Conroy Background

- Boot Barn Management Bios

- New Supply Chain Automation Solutions

- Q3 '23 Call Transcript

Disclosure: I do not yet have an advantageous long position in the shares of BOOT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article. I am not an investment advisor, and this article does not recommend purchasing or selling stock. Investors are advised to review all company documents and press releases to see if the company fits their investment qualifications.

Comments

Post a Comment