Well well well ... what a month that has passed. Happy April, and good Monday morning to all you beautiful bastards. Between these bank runs, inflation rates, and bear market rallies, what a confusing time for investors. Let's jump right into what we should be thinking about over the next month.

Current Situation

Despite the ongoing bank crisis, stocks have been holding up quite well and growth stocks seem to be rallying. The Fed and FDIC have provided bank bailouts, which have helped to keep investors from panicking, exiting their savings accounts, and selling off their stocks. However, there is concern that the government may not be able to prevent further negative effects on the economy as the financial institutions, especially regional banks, have become weaker. This will likely have an impact on lending to real estate, consumers, and businesses. While people are not talking about it now, it will become obvious that these are the sparks that ignite the next market crash. Several banks are still struggling and crashing, such as First Republic and Credit Suisse, which fell by more than 50%, with the latter agreeing to be taken over by UBS Group. It is difficult to determine what is keeping stocks up currently, as it's not the valuation or hope for the economy bouncing back. Investors may be betting on a Fed rate cut to support the economy, but inflation and the Fed itself are trying to prevent this.

It is important for investors to know, that US banks currently hold almost half of the $4.5 trillion in commercial property debt, equaling about $1.75 trillion, $400 billion of which will need refinancing this year. However, banks are tightening their lending standards, and investors with LLC-protected properties are already defaulting on higher interest rates. The Federal Reserve’s Senior Loan Officer Survey shows that lending standards have tightened to the worst levels since May 2020. The report suggests that the situation will continue to worsen over the next few months, as banks cannot loan money without having confidence that their assets will cover deposits. Moreover, the gap between regional bank assets and their deposits is expected to be at least $1 trillion, due to the fastest rate increase in 40 years. With $1.8 trillion of corporate debt rated by S&P Global set to mature this year, the refinancing market will become more challenging, and 13% of companies already rated as junk are likely to face higher rates.

If real estate and the corporate side of the economy crumbles, the last piece remaining will be consumer spending. Currently, consumers make up 70% of the US economy, and although the job market is strong, higher interest rates and tighter lending standards may impact unemployment rates, which could scare consumers into saving, and the economy's last leg will be pulled out from under it. The Fed and Treasury Secretary Yellen may not admit to this, even though Chair Powell forecasted a recession a year ago. The yield curve, which shows the difference between short-term and long-term interest rates, is currently inverted and has historically indicated an impending recession.

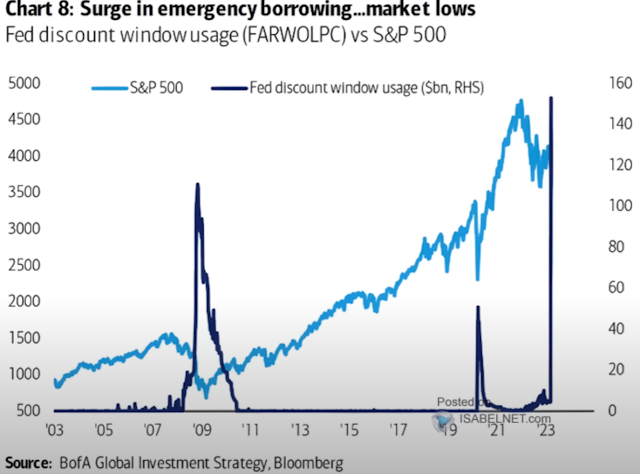

To support these hypotheses, let's take a quick look at the Fed borrowing back in 2008, during the middle of an economic turndown before the second deeper plunge took place. This looks very similar to what is happening right now where a lot of banks are asking for emergency funding.

At this point, the question is not if there is a recession or a hard landing, but when.

Two Possible Scenarios

1. The Three-Phase Rate Reverso

Slow down, stop, then reverse.

If we follow this scenario, the economy is currently in the slow down portion of the three-phase rate reverso. Whether they continue to slow down the rate hikes in the next couple of months or just stop entirely, we are soon to enter the second part of this phase near the summertime of this year. For the last phase to begin, a reversing will have to be triggered due to something breaking. This event would not be good and is against what the Fed wishes, they want to remain in a higher rate environment to curb stomp inflation. The only way this happens is through a reactionary response against a crisis. Both the stock market and crypto will freefall if this happens.

Some people believe the rate at which the economy is recovering from the high inflation environment of last year indicates we could achieve a 2% inflation rate as early as next year. Well, I hate to disappoint, but let's put this into a different perspective. We have shed from last year's peak inflation rate of 9.1 to the current 6.0 extremely fast, but just like in dieting, the first few pounds are easily lost in the beginning. It gets progressively more difficult the more weight you lose to shed what remaining weight there is, and in the economy's case, energy and goods inflation was the cause for this rapid inflation reduction.

The problem is inflation is stickier than people are willing to admit. Not to mention energy prices and commodities are both starting to rebound from their lows... Oil prices jumped by over 20% to $81 per barrel (Sunday evening WTI prices) from the lows this month due to their oversold conditions. However, comments from the Biden administration that it could take years to refill the Strategic Petroleum Reserve affected investors who were betting on stronger demand. Despite this, economic growth in China and good demand from the US and EU for the next month or two are expected to keep oil prices above $70 per barrel, but many others believe oil will hit triple digits in late 2023.

What currently is going on seems to be a bear market rally for sure.

2. The Slowdown Into A Firm Rate Hold

The second scenario is that the Fed will slow down to summer and hold throughout the rest of 2023 without the need for rate cuts. Many investors are expecting them to change their tune and lower interest rates, even though they have been talking tough about keeping rates high. The reason for this expectation is the fear that the banking crisis will get worse and that the Fed will have to step in and rescue the economy with low rates. If there is no recession, there will be no need for a Fed cut. This is very unlikely but the Fed believes the job market will remain strong and GDP will stay positive for 2023. I have to say this seems like a fantasy land, even major companies like Facebook, Google, Microsoft, and Tesla are all doing job cuts, so I'm not sure how the job market will remain strong throughout this year. But who am I compared to some institutions that have openly gone against this viewpoint...

The asset management firm BlackRock has recently said that they don't think the Fed will lower rates anytime soon. They explain that the Fed is currently more focused on curbing inflation and maintaining financial stability and that lowering rates would conflict with those goals. BlackRock thinks that the Fed would only lower rates if things got really bad and a serious credit crunch took hold. A credit crunch is when financial institutions tighten their lending practices, making it harder for money to circulate and putting a tighter break on the economy. So, while many people are expecting the Fed to pivot and lower rates, BlackRock thinks it's unlikely, at least for now.

The market has priced in what the Fed is saying they will do ... but the Fed has never lied about anything before right? *EHEM* TRANSITORY INFLATION *EHEM*

So... Now What?

There will be many opportunities for almost every asset class, including real estate, crypto, and the overall stock market coming later this year when the full effect of the impending economic recession will hit rock bottom. It's important to note that investors do not need to get in at the absolute lowest prices, but being within a few months of accuracy can help increase the long-term gains through a favorable entry price while minimizing the importance of timing accuracy individuals sometimes solely rely on when for entering the market. For now, I believe investors should be patient and let the economy play out, and probably reenter an asset class of their choosing in late 2023 / early 2024.

Comments

Post a Comment